Unicorn Financial Services Fundamentals Explained

Wiki Article

The Best Strategy To Use For Melbourne Broker

Table of ContentsUnicorn Financial Services Can Be Fun For EveryoneExamine This Report about Refinance Broker MelbourneHow Broker Melbourne can Save You Time, Stress, and Money.Top Guidelines Of Melbourne BrokerMortgage Broker In Melbourne Things To Know Before You Get This

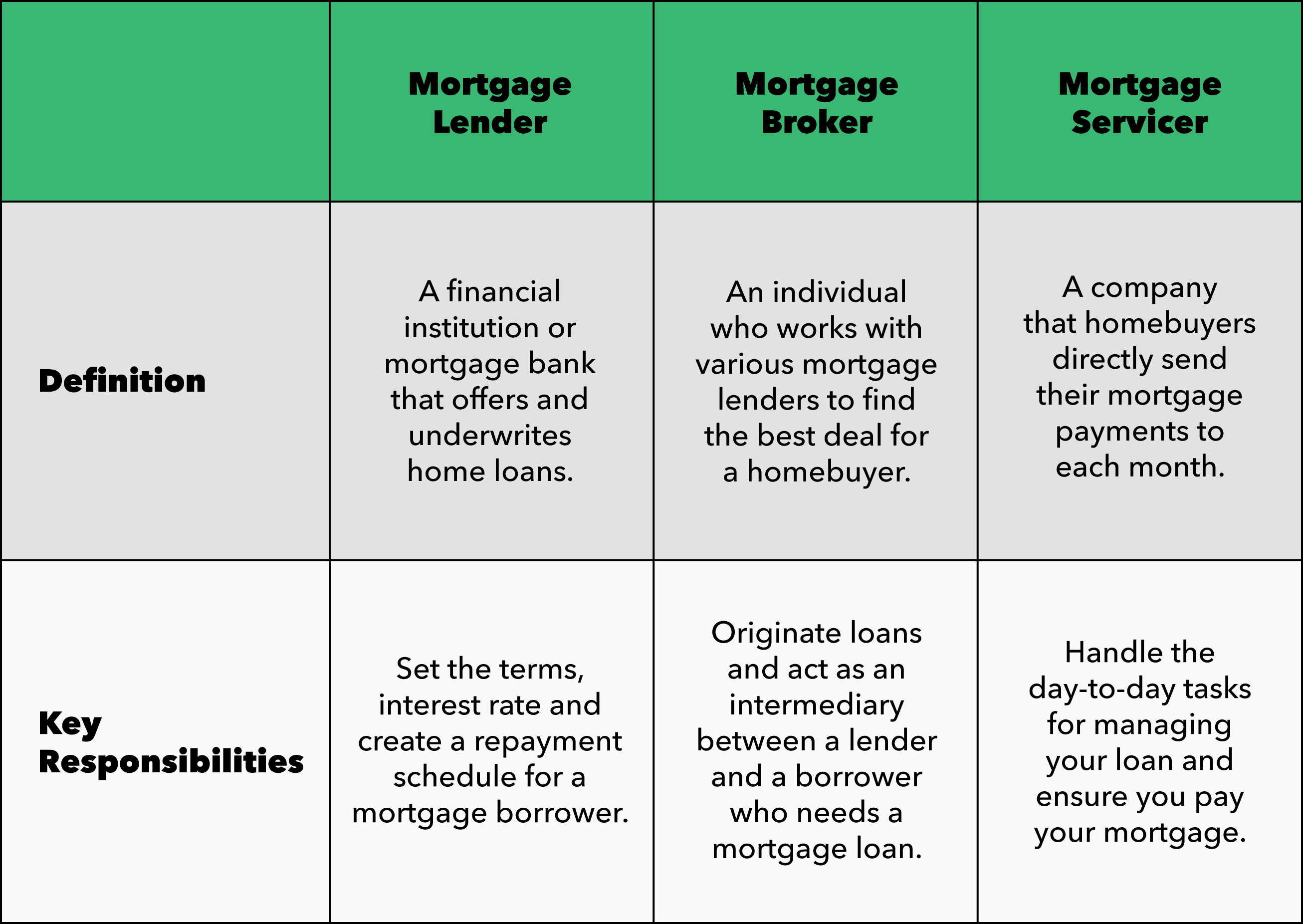

Brokers can not be paid by you and by the lender, as well as they can't obtain kickbacks from affiliated services. A mortgage broker can conserve customers time and tension by finding as well as vetting financings and handling the mortgage process.A mortgage broker might be able to obtain special rates that are reduced than what you can acquire from a loan provider on your very own. A broker can aid you take care of home loan fees by getting the loan provider to lower or forgo them, which can save hundreds or perhaps countless dollars.

A broker can aid in tough economic scenarios, such as a buyer with less-than-perfect credit score or irregular earnings. Brokers are typically knowledgeable about lenders that will collaborate with nontraditional consumers as well as can assist determine the finest offered financings and also prices. A broker can conserve you from errors based on the broker's competence of the home mortgage market.

In the affordable mortgage organization, brokers seeking to close as many lendings as promptly feasible may not constantly offer terrific service. A consumer who stops working to research study mortgage brokers can wind up with an error-prone broker that makes homebuying tedious and also hard. Finding a trusted regional broker may be tough depending upon where you live.

The Greatest Guide To Melbourne Mortgage Brokers

You might wish to use a home mortgage broker if: You don't have time or patience for the home mortgage application procedure, or you're in a hurry to safeguard a mortgage. You do not have great credit scores or you run your very own company, as well as you are struggling to locate mortgages that will certainly help you (https://topbusinesslisting.com/mortgage-broker/unicorn-financial-services-springvale-victoria/).

You would such as a broker to aid you waive or lower your mortgage charges. You would certainly such as access to a broker's network of lenders.

Request for referrals from good friends, relative or experienced real estate agents; speak with individuals that have recently gotten homes; as well as study reviews. As you are combing through reviews, see to it you assess the broker and also not the broker agent company. "The No. 1 point consumers who are purchasing lendings ought to do is consider third-party evaluations for the specific begetter," claims Jennifer Beeston, branch supervisor as well as senior vice head of state of mortgage lending at Surefire Price, an on-line mortgage lending institution.

The Main Principles Of Home Loan Broker Melbourne

Interviewing brokers can additionally assist you discover the best mix of personality, expertise, responsive communication and depend on. It can give you a good suggestion of the solution top quality as well as the flow of the home mortgage procedure."You should feel comfortable with the mortgage broker and seem like you can inform them anything, because in order to have a successful funding, you need to inform them every little thing," Beeston states. "You do not desire a connection where you seem like they're condescending, or you seem like a burden or a hassle, because there's so several gifted brokers that would certainly love your organization."Doing due persistance before you employ a broker can help you really feel reasonably certain that you've selected a person trustworthy who will communicate properly, worth your company, shield your rate of interests and also fulfill target dates.

If the broker and the representative don't connect properly, money can be left on the table, states Elysia Stobbe, writer of "Exactly how to Get Authorized for the Finest Home Loan Without Sticking a Fork in Your Eye.""Ask them concerns just like you would certainly when you most likely to a physician," Stobbe says.

"Simply due to the fact that a home loan broker's qualified does not indicate they're competent at their craft," Stobbe says.

The 45-Second Trick For Melbourne Broker

None people like to think regarding the truth that we're mosting likely to pass away eventually, regardless of the inescapable fact that the pale horse is coming for all of us (https://headbizlisting.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). Perhaps that's why over fifty percent of us do not have a will.

If you function with your regional financial institution, you will just have actually obtaining options provided by that financial institution. This is a quite narrow range, considering the numerous loan providers out there, yet banks will not be offering you products from one more competitor. Making use of a home mortgage broker provides you access to a larger series of lenders.

And also, some lenders just work with customers presented to them by a broker, so making use of a mortgage broker can give you better access to loan providers. Together with more lenders comes the capacity for safeguarding much better items. Naturally, the extra choices you have, the more probable you are to discover your ideal item suit.

Refinance Broker Melbourne for Dummies

Using a mortgage broker takes a great deal of that tension far from you. melbourne mortgage brokers. With a broker, you do not need to bother with browsing the market alone, searching for the right budget as well as a lender to finance your mortgage. Brokers can aid you identify your home acquiring objectives, as well as just how your income and also expenditures compose your spending plan.Report this wiki page